UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | | |

Filed by the Registrant ý | |

Filed by a Party other than the Registrant o | |

| Check the appropriate box: | |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

| | | | | | | | | | | | | | |

| Veritex Holdings, Inc. | | | | |

| (Name of Registrant as Specified In Its Charter) | | | | |

| | | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | | | | |

| | | | |

| Payment of Filing Fee (Check the appropriate box): | | | | |

ý | | No fee required. | | |

o

| | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. | | |

| o | | Check box if any part of the fee is offset as providedFee computed on table in exhibit required by item 25(b) per Exchange Act Rule 0-11(a)(2)Rules 14a-6(i)(1) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed:0-11. |

Veritex Holdings, Inc.

8214 Westchester Drive, Suite 800

Dallas, Texas 75225

(972) 349-6200

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 19, 2020

NOTICE IS HEREBY GIVEN that the 20202023 annual meeting of shareholders (the “Annual Meeting”) of Veritex Holdings, Inc. (the “Company”) will be held as follows:

| | | | | |

TIMEDATE AND DATETIME: | 3:30Thursday, May 18, 2023, at 2:00 p.m., Central Time

Tuesday, May 19, 2020

|

PLACELOCATION: | 8214 Westchester Drive, Suite 735

Dallas, Texas 75225

This year, a live webcast of the Annual Meeting will be accessible over the internet at https://onlinexperiences.com/Launch/QReg/ShowUUID=14364ABD-D97F-4A42-B775-C2C2C13CB697, where you will be able to listen to the meeting live, submit questions and vote. Registration to the webcast is required to join.

|

ITEMS OF BUSINESSBUSINESS: | 1.Election of thirteen (13) directors of the Company; 2.Non-binding advisoryadvisory vote on the compensation of the Company’s named executive officers; and 3.Ratification of the appointment of Grant Thornton LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2020; and 4.Transaction of such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.2023.

|

RECORD DATEDATE: | Only shareholders of record of Company common stock at the close of business on March 31, 2020April 5, 2023 are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. |

PROXY VOTING | It is important that your shares be represented and voted at the Annual Meeting. For instructions on voting, please refer to the enclosed proxy card or voting information form. A list of shareholders entitled to vote at the Annual Meeting will be available for examination by any shareholder at the principal place of business of the Company during ordinary business hours for a period of 10 days prior to the Annual Meeting. This list also will be available for inspection to shareholders who attend the Annual Meeting. |

| | | | | | | | |

| | By Order of the Board of Directors, |

| | |

| | C. Malcolm Holland, III Chairman of the Board, Chief Executive Officer and President |

| | Dallas, Texas April 17, 20202023 |

| | | | | | | | | | | | | | |

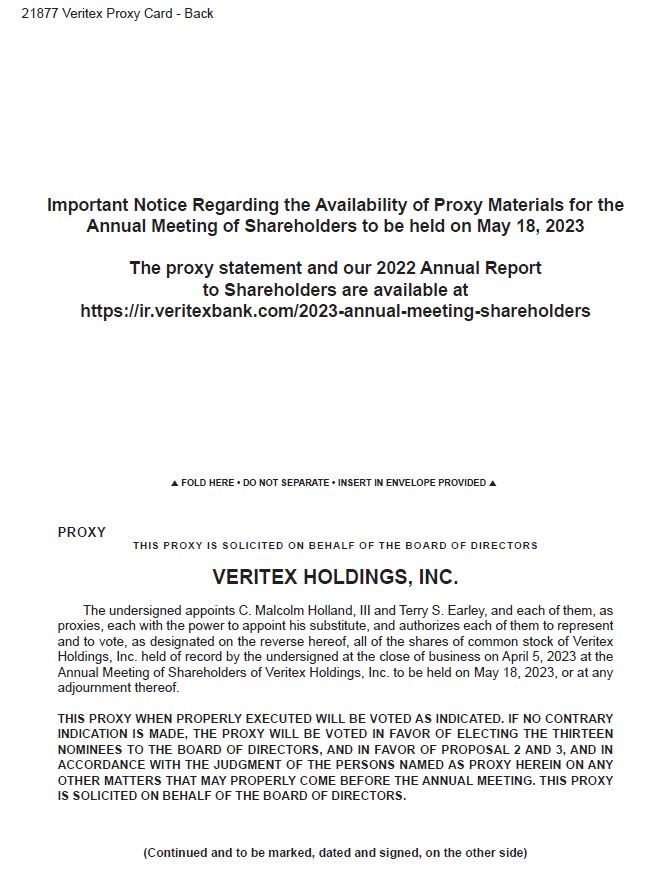

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS for the 2023 Annual Meeting of Shareholders to be held on May 18, 2023:

The Veritex Holdings, Inc. 2023 Notice of Annual Meeting of Shareholders, the accompanying proxy statement, the 2022 annual report (including the Company's Annual Report on Form 10-K) and other proxy materials are available at https://ir.veritexbank.com/ under the Special Meeting tab. |

Your vote is important! You are encouraged to vote as soon as possible. Whether or not you plan to attend the meeting, please read the proxy statement in its entirety and then vote by completing, signing and dating the enclosed proxy card and promptly mailing it in the enclosed envelope. For your convenience, you may also vote via the Internet or by telephone per the instructions on the proxy card. Enrolling in electronic delivery reduces Veritex's printing and mailing expenses and environmental impact. Submitting your proxy by one of these methods will ensure that your shares are represented at the Annual Meeting. |

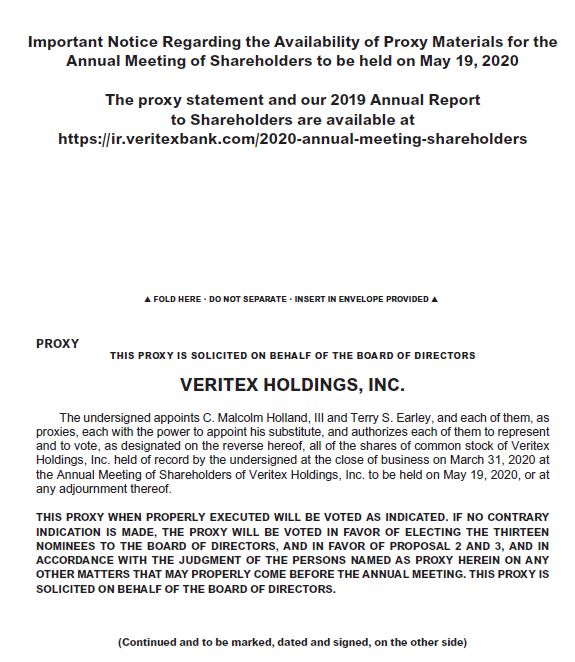

Important Notice Regarding the Availability of Proxy Materials for the 2020 Annual Meeting of Shareholders to Be Held on May 19, 2020: The proxy statement, this accompanying notice of the Annual Meeting, a form of proxy card and our 2019 annual report to shareholders are available at https://ir.veritexbank.com/2020-annual-meeting-shareholders.To obtain directions to attend the Annual Meeting in person, please contact us at (972) 349-6132.

Your Vote is Important

Whether or not you plan to attend the Annual Meeting, please read the proxy statement in its entirety and then vote by completing, signing and dating the enclosed proxy card and promptly mailing it in the enclosed envelope, or vote over the Internet pursuant to the instructions provided in the enclosed proxy card. You may revoke your proxy in the manner described in the proxy statement at any time before it is exercised. See “About the Annual Meeting—May I change my vote after I have submitted a proxy?” for more information on how to vote your shares or revoke your proxy.

TABLE OF CONTENTS

VERITEX HOLDINGS, INC.

8214 Westchester Drive, Suite 800

Dallas, Texas 75225

PROXY STATEMENT FOR

2020 2023 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 19, 202018, 2023

Unless the context otherwise requires, references in this proxy statement to (a) “we,” “us,” “our,” “our company,” the “Company” or “Veritex” refer to Veritex Holdings, Inc., a Texas corporation, and its consolidated subsidiaries as a whole; references to(b) the “Bank” referrefers to Veritex Community Bank, a wholly owned subsidiary of the Company. In addition, unless the context otherwise requires, references toCompany; and (c) “shareholders” are to the holders of our common stock, par value $0.01 per share (the “common stock”).

This proxy statement is being furnished in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board”) for use at the 20202023 annual meeting of shareholders of the Company to be held on Thursday, May 18, 2023, at 2:00 p.m., Central Time, at 8214 Westchester Drive, Suite 735, Dallas, Texas 75225 and any adjournment or postponement thereof (the “Annual Meeting”) for the purposes set forth in this proxy statement and the accompanying notice of the Annual Meeting. The Annual Meeting will be held as a “hybrid” meeting on Tuesday, May 19, 2020, at 3:30 p.m., Central Time, with a physical location at 8214 Westchester Drive, Suite 735, Dallas, Texas 75225. Simultaneously, the Annual Meeting willcan be conductedaccessed via live webcast at teleconference by registering via teleconference at:

https://onlinexperiences.com/Launch/QReg/ShowUUID=14364ABD-D97F-4A42-B775-C2C2C13CB697. Shareholders attendingregister.vevent.com/register/BIbfb9848e1d4f44c0b308860b6fb93fe3. Even if you plan to participate in the Annual Meeting, via live webcast will be able to listen to the meeting live, submit questions and vote. [Please note that shareholders using the dial-in number for the listen-only telephonic conference call will be able to listen to the meeting live but will not be able to vote or submit questions.]

We intend to hold our Annual Meeting in person at, and broadcast the meeting from, 8214 Westchester Drive, Suite 735, Dallas, Texas 75225. However, we are actively monitoring the outbreak of the novel coronavirus (COVID-19) and are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may continue to impose. In the event it is not possible or advisable to hold our Annual Meeting at 8214 Westchester Drive, Suite 735, Dallas, Texas 75225, we will conduct our Annual Meeting solely by means of remote communication via https://onlinexperiences.com/Launch/QReg/ShowUUID=14364ABD-D97F-4A42-B775-C2C2C13CB697, and make an announcement to that effect as promptly as practicable. Please monitor our website at www.veritexbank.comfor updated information. If you are planning to attend our Annual Meeting in person, please check the website 10 days prior to the meeting date. As always, we encourageurge you to votesubmit your proxy in advance to ensure your shares prior to our Annual Meeting.are represented.

This proxy statement, the accompanying notice of the Annual Meeting, the 20192022 annual report to shareholders (including the Company's annual report on Form 10-K) and the proxy card (collectively, the “proxy materials”) are first being sent on or about April 17, 20202023 to shareholders of record entitled to vote at the Annual Meeting at theMeeting. Our Board of Directors has fixed close of business on March 31, 2020.April 5, 2023 as the record date. You should carefully read this entirethe proxy statement carefullymaterials in their entirety before voting.

Important Notice Regarding the Availability of Proxy Materials for the 20202023 Annual Meeting of Shareholders to Be Held on May 19, 202018, 2023

ThisThe proxy statement and the Company’s 2019 annual report to shareholdersmaterials are available at https://ir.veritexbank.com/2020-annual-meeting-shareholders. We encourageencourage you to access and review all of the information in the proxy materials before voting.

ABOUT THE ANNUAL MEETING

When and where will the Annual Meeting be held?

The Annual Meeting is scheduled to take place at 3:302:00 p.m., Central Time, on Tuesday,Thursday, May 19, 2020,18, 2023, at 8214 Westchester Drive, Suite 735, Dallas, Texas 75225. Simultaneously, the Annual Meeting willcan be conductedaccessed via live webcast at teleconference by registering via teleconference at:

https://onlinexperiences.com/Launch/QReg/ShowUUID=14364ABD-D97F-4A42-B775-C2C2C13CB697.register.vevent.com/register/BIbfb9848e1d4f44c0b308860b6fb93fe3. Shareholders attendingusing the dial-in number to attend the Annual Meeting via live webcastteleconference will be able to listen to the meeting live but will not be able to vote or submit questions and vote.questions.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will be asked to vote on the following proposals:

•Proposal 1. Election of thirteen (13) directors of the Company;

•Proposal 2. Non-binding advisory vote on the compensation of the Company’s named executive officers; andofficers ("NEOs");

•Proposal 3. Ratification of the appointment of Grant Thornton LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2020.2023.

Shareholders also will transact any other business that may properly come before the Annual Meeting or any adjournment or postponement thereof. Members of our management team will be present at the Annual Meeting.

Who are the nominees for directors?

The following thirteen persons have been nominated for election as directors:

C. Malcolm Holland, III

Arcilia Acosta

Pat S. Bolin

April Box

Blake Bozman

William D. Ellis

William E. Fallon

Ned N. Fleming, III

Mark C. Griege

Gordon Huddleston

Steven D. Lerner

Manuel J. Mehos

Gregory B. Morrison

John T. Sughrue

Who is entitled to vote at the Annual Meeting?

The holders of record of outstanding common stock at the close of business on March 31, 2020,April 5, 2023, which is the date that the Board has fixed as the record date for the Annual Meeting (the “record date”), are entitled to vote at the Annual Meeting. Each holder of record of our outstanding common stock on the record date will be entitled to one vote for each share of commoncommon stock registered in such holder’s name on each matter to be voted upon at the Annual Meeting. On the record date, 49,557,36454,229,033 shares of common stock were outstanding.

Why will the Annual Meeting be accessible via live webcast [and telephonically]?

We are actively monitoring the outbreak of the novel coronavirus (COVID-19) and are sensitive to the public health and travel concerns our shareholders may have and the protocols that federal, state, and local governments may continue to impose. We are hopeful that making attendance at the Annual Meeting possible via live webcast [and telephonically] will encourage continued shareholder participation and enhance our ability to communicate with shareholders notwithstanding these events.

How can I attend the Annual Meeting via live webcast?

If you plan to attend the Annual Meeting through live webcast at https://onlinexperiences.com/Launch/QReg/ShowUUID=14364ABD-D97F-4A42-B775-C2C2C13CB697, please use your 16-digit control number provided on your proxy card, voting instruction form or notice to enter the live webcast of the Annual Meeting. Instructions on how to attend and participate via the internet webcast, including how to demonstrate proof of common stock ownership, are posted a thttps://onlinexperiences.com/Launch/QReg/ShowUUID=14364ABD-D97F-4A42-B775-C2C2C13CB697.

How do I vote?

You may vote your shares of common stock either in person at the Annual Meeting or by proxy. The process for voting your shares depends on how your shares are held, as described below.

Shareholders of Record: Shares Registered in Your Name

If you are a shareholder of record on the record date for the Annual Meeting, you may vote by proxy or you may attend the Annual Meeting and vote in person. If you are a shareholder of record and want to vote your shares by proxy, you have two ways to vote:

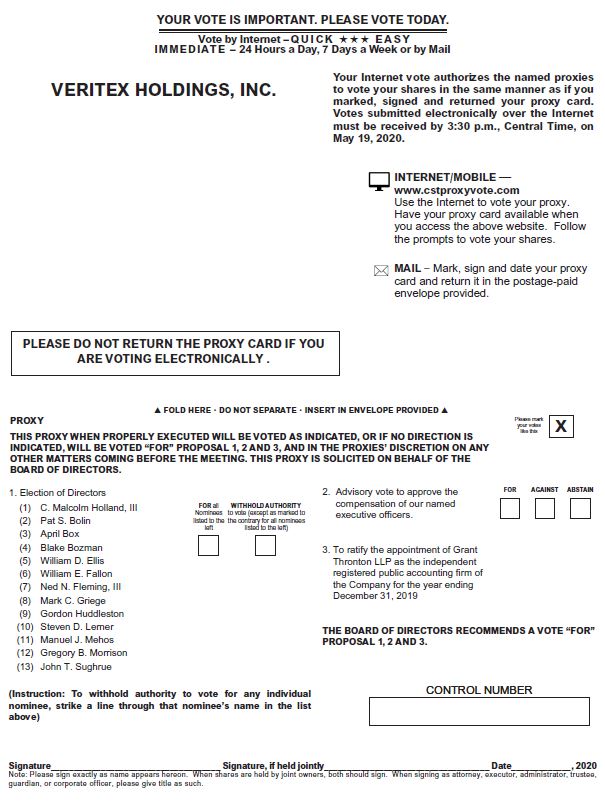

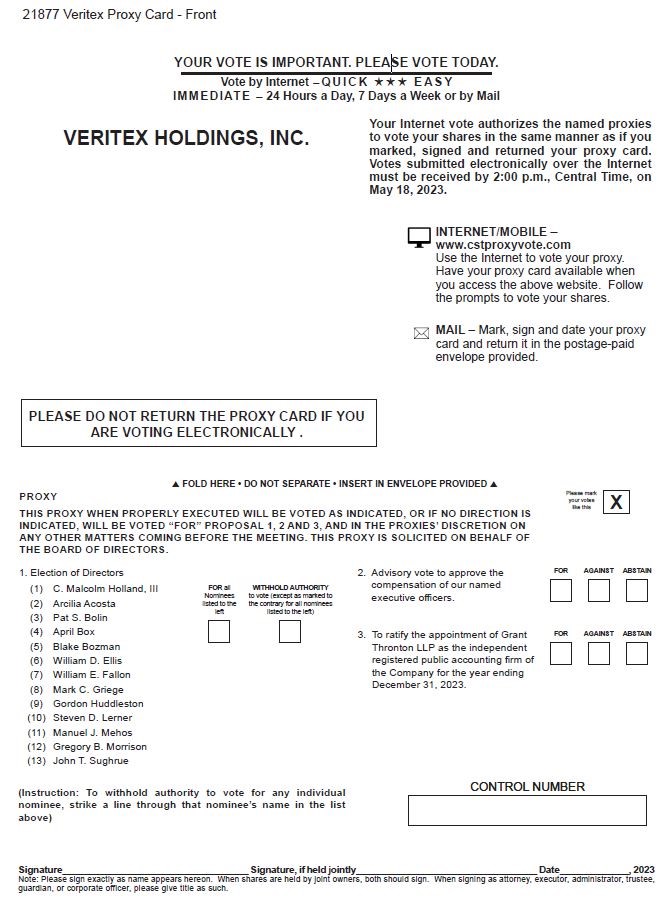

•By Mail: Indicate on the proxy card(s) applicable to your common stock how you want to vote and sign, date and mail your proxy card(s) in the enclosed pre-addressed postage-paid envelope as soon as possible to ensure that it will be received in advance of the Annual Meeting.

•Over the Internet: VisitVisit the website www.cstproxyvote.com. HaveHave your proxy card in hand when you access the website. Enter your control number from your proxy card and follow the instructions for Internet voting on that website.

Please refer to the specific instructions set forth in your proxy card for additional information on how to vote. Voting your shares by proxy will enable your shares of common stock to be represented and voted at the Annual Meeting if you do not attend the Annual Meeting and vote your shares in person or via live webcast.person.

We must receive your proxy card by mail by no later than the time the polls close for voting at the Annual Meeting for your vote to be counted at the Annual Meeting. Please note that Internet voting will close at 10:59 p.m., Central Time, on May 18, 2020.17, 2023.

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If you hold your shares in “street name,” your bank, broker or other nominee should provide you with a voting instruction card and our proxy materials. By completing the voting instruction card, you may direct your nominee how to vote your shares. If you complete the voting instruction card but do not provide voting instructions with respect to one or more proposals, then your broker will be unable to vote your shares with respect to each proposal as to which you provide no voting instructions, except that your broker has the discretionary authority to vote your shares with respect to the ratification of the appointment of Grant Thornton LLP as our independent registered public accountingaccounting firm (Proposal 3). If your sharesshares of common stock are held in “street name,” your ability to vote over the Internet depends on your broker’s voting process. You should follow the instructions on the voting instruction card provided to you by your bank, broker or other nominee.

To vote the shares that you hold in “street name” in person at the Annual Meeting, you must bring a legal proxy from your broker, bank or other nominee (i) confirming that you were the beneficial owner of those shares as of the close of business on the record date, (ii) stating the number of shares of which you were the beneficial owner that were held for your benefit on the record date by that broker, bank or other nominee and (iii) appointing you as the record holder’s proxy to vote the shares covered by that proxy at the Annual Meeting. If you fail to bring a nominee-issued proxy to the Annual Meeting, you will not be able to vote your nominee-held shares in person at the Annual Meeting.

To vote the shares that you hold in “street name” via live webcast at the Annual Meeting, please follow the instructions at https://onlinexperiences.com/Launch/QReg/ShowUUID=14364ABD-D97F-4A42-B775-C2C2C13CB697. If you plan to vote via live webcast, you will need the 16-digit control number provided on your proxy card, voting instruction form or notice.

May I vote my shares at the Annual Meeting telephonically?

No. Those using the dial-in number to access the listen-only telephonic conference call will not be able to vote or submit questions. We encourage all shareholders to vote their shares in advance of the Annual Meeting by signing and returning their proxy cards to us indicating how they wish to vote.

What is the difference between a shareholder of record and a “street name” holder?

If your shares are registered directly in your name with Continental Stock Transfer & Trust Company, our stock transfer agent, you are considered the shareholder of record with respect to those shares. Our proxy materials are being sent directly to you by Continental Stock Transfer & Trust Company at our request.

If your shares are held in a brokerage account or by a bank or other nominee, the nominee is considered the record holder of those shares. You are considered the beneficial owner of these shares, and your shares are held in “street name.” Our proxy materials are being forwarded to you by your nominee along with a voting instruction card. As the beneficial owner, you have the right to direct your nominee how to vote your shares by using the voting instructions card.

What constitutes a quorum for the Annual Meeting?

The holders of a majority of the stock issued and outstanding and entitled to vote at the Annual Meeting present in person, by participation through https://onlinexperiences.com/Launch/QReg/ShowUUID=14364ABD-D97F-4A42-B775-C2C2C13CB697 or represented by proxy, shall constitute a quorum for the transaction of business. On the record date, 49,557,36454,229,033 shares of commoncommon stock were outstanding.

What is a broker non-vote?

A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner. Your broker has discretionary authority to vote your shares with respect to the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm (Proposal 3). In the absence of specific instructions from you, your broker does not have discretionary authority to vote your shares with respect to anyany other proposal.

What should I do if I receive more than one set of voting materials?

You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. Similarly, if you are a shareholder of record and hold shares in a brokerage account, you will receive a proxy card for shares held in your name and a voting instruction card for shares held in “street name.” Please complete, sign, date and return each proxy card and voting instruction card that you receive to ensure that all your shares are voted.

What are the Board’s recommendations on how I should vote my shares?

The Board recommends that you vote your shares as follows:

Proposal 1—FOR the election of all of the nominees for director;

Proposal 2—FOR the approval of, on a non-binding advisory basis, the compensation of our named executive officers,NEOs, as disclosed in this proxy statement;

Proposal 3—FOR the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020.2023.

How will my shares be voted if I return a signed and dated proxy card, but don’t specify how my shares will be voted?

If you are a record holder who returns a completed proxy card that does not specify how you want to vote your shares on one or more proposals, the proxies will vote your shares in accordance with the Board’s recommendations described above in “—What are the Board’s recommendations on how I should vote my shares?”

If you are a “street name” holder and do not provide voting instructions on one or more proposals, your bank, broker or other nominee will be unable to vote those shares, except that the nominee will have discretion to vote on the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm (Proposal 3).

What are my choices when voting?

Your choices when voting are as follows:

Proposal 1—Election of directors—You may vote for all director nominees or you may withhold your vote as to one or more director nominees.

Proposal 2—Approval of, on a non-binding advisory basis, the compensation of our named executive officers—YouNEOs —You may vote for the proposal, vote against the proposal or abstain from voting on the proposal.

Proposal 3—Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm—You may vote for the proposal, vote against the proposal or abstain from voting on the proposal.

What percentage of the vote is required to approve each proposal?

The following votes are required to approve each proposal:

Proposal 1—Election of directors—The affirmative vote ofDirectors are elected by a plurality of the votes cast at the Annual Meeting. For purposes of the election of directors, votes that are “withheld” and broker non-votes will be counted as “present” for purposes of establishing a quorum but will not be counted as votes cast and will have no effect on the result of the vote. Shareholders may not cumulate votes in the election of directors. In accordance with our Director Resignation Policy, any nominee for election as a director who receives a greater number of “withhold” votes than votes “for” election in an uncontested election must tender his or her resignation in writing to the Board no later than ten days after the certification of the shareholder vote. The Board will determine whether to accept the resignation based upon the recommendation of the Corporate Governance and Nominating Committee and consideration of the circumstances. The Company will publicly disclose the Board’s decision and the process by which it was reached.

Proposal 2—Approval of, on a non-binding advisory basis, the compensation of our named executive officers—TheNEOs —The affirmative vote of a majority of the votes cast at the Annual Meeting.

Proposal 3—Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm—The affirmative vote of a majority of the votes cast at the Annual Meeting.

How are broker non-votes and abstentions treated?

Broker non-votes are counted for purposes of determining the presence or absence of a quorum. Your broker will have discretionary authority to vote your shares with respect to the ratification of Grant Thornton LLP as our independent registered public accounting firm (Proposal 3) so we do not expect any broker non-votes in connection with that proposal. Broker non-votes are not considered votes cast and will have no effect on the outcome of the votes on Proposals 1 or 2.

Votes withheld (for Proposal 1) and abstentions (for Proposals 2 and 3)Proposal 2) are counted for purposes of determining the presence or absence of a quorum. Votes withheld and abstentions are not considered votes cast. Therefore, votes withheld will have no effect on the outcome of the votes on Proposal 1, and abstentions will have no effect on the outcome of the votes on Proposals 2 or 3.Proposal 2.

May I change my vote after I have submitted a proxy?

Yes. Regardless of the method used to cast a vote, if you are a shareholder of record, you may change your vote by:

•delivering to us a written notice of revocation addressed to Veritex Holdings, Inc., 8214 Westchester Drive, Suite 800, Dallas, Texas 75225, Attn: Corporate Secretary,Investor Relations, no later than the time the polls close for voting at the Annual Meeting;

•completing, signing and returning a new proxy card with a later date than your original proxy card, no later than the time the polls close for voting at the Annual Meeting, and any earlier proxy will be revoked automatically;

•casting a new vote over the Internet by visiting the website specified in your proxy card and following the instructions indicated on the proxy card before the Internet voting deadline of 10:59 p.m., Central time, on May 18, 2020;17, 2023; or

•attending the Annual Meeting and voting in person or via live webcast, and any earlier proxy will be revoked. However, attending the Annual Meeting in person or via live webcast will not automatically revoke your proxy unless you vote again in person at the Annual Meeting in person or via live webcast.person.

If your shares are held in “street name” and you desire to change any voting instructions you have previously given to the record holder of the shares of which you are the beneficial owner, you should contact the broker, bank or other nominee holding your shares in “street name” in order to direct a change in the manner your shares will be voted.

What are the solicitation expenses and who pays the cost of this proxy solicitation?

Our Board is asking for your proxy, and we will pay all of the costs of soliciting shareholder proxies. In addition to the solicitation of proxies via mail, our officers, directors and employees may solicit proxies personally or through other means of communication, such as e-mail, without being paid additional compensation for such

services. We will reimburse banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding the proxy materials to beneficial owners of our common stock.

Are there any other matters to be acted upon at the Annual Meeting?

Management does not intend to present any business at the Annual Meeting for a vote other than the matters set forth in the notice of the Annual Meeting, and management has no information that others will do so. The proxy also confers on the proxies the discretionary authority to vote with respect to any matter properly presented at the Annual Meeting. If other matters requiring a vote of the shareholders properly come before the Annual Meeting, it is the intention of the persons named in the accompanying form of proxy to vote the shares represented by the proxies held by them in accordance with applicable law and their judgment on such matters.

Where can I find voting results?

We will publish the voting results in a Current Report on Form 8-K, which we will file with the Securities and Exchange Commission (the “SEC”) within four business days following the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

How can I communicate with the Board?

To communicate with the Board, shareholders should submit their comments by sending written correspondence via mail or courier to Veritex Holdings, Inc., 8214 Westchester Drive, Suite 800, Dallas, Texas 75225, Attn: Corporate Secretary;Investor Relations; or via e-mail to scaudle@veritexbank.com.investorrelations@veritexbank.com. Shareholder communications will be sent directly to the specific director or directors indicated in the communication or to all members of the Board if not specified.

PROPOSAL 1. ELECTION OF DIRECTORS

Number of Directors; Term of Office

Our bylaws currently provide that the number of directors which shall constitutethat constitutes the entire Board shall be determined from time to time by resolution adopted by a majority of the Board and shall not be less than three. Each director shall hold office untilfor the next succeeding annual meeting of shareholdersterm for which such director is elected, and until such director’s successor shall have been elected and qualified, or until such director’s earlier death, resignation or removal.

Our Board presently has nine members and our Board has nominated thirteen nominees to be elected at the Annual Meeting. If elected, all nominees will serve for a term commencing on the date of the Annual Meeting and continuing until the 2021 annual meeting of shareholders or until each person’s successor is duly elected and qualified. Each nominee has agreed to serve if elected. If any named nominee is unable to serve, proxies will be voted for the remaining named nominees. Each of the nominees listed below is currently serving as a director on the Board and each nominee was previously elected by our shareholders.

Nominees for Election

Our Board has nominated thirteen nominees to be elected at the Annual Meeting. The Board believes that the experience and qualifications of the nominees enhances our Board’s effectiveness and is aligned with the Company’s long-term strategy. Our directors have a combined wealth of leadership experience derived from extensive service guiding large, complex organizations as executive leaders or board members and in government, academia and public policy, and possess a diversity of qualifications, attributes and skills applicable to our business.

If elected, all nominees will serve for a term commencing on the date of the Annual Meeting and continuing until the 2024 annual meeting of shareholders or until each person’s successor is duly elected and qualified. Each nominee has agreed to serve if elected. We do not anticipate that any nominee will be unable or unwilling to stand for election, but if that occurs, your proxy vote may be voted for another person nominated by the Board or the Board may reduce the number of directors to be elected. Each of the nominees listed below is currently serving as a director on the Board and each nominee was previously elected by our shareholders.

The following table sets forth the name, age and positions with us for each nominee for election as a director:director, together with a list of the committee on which each director currently serves:

| | | | | | | | | | | | | | | | | | | | |

| Name of Nominee | | Age | | Position(s) Held in the Company | | Director Since |

| C. Malcolm Holland, III | | 60 | | Chairman of the Board, Chief Executive Officer and President | | 2009 |

Pat S. Bolin1 | | 69 | | Director | | 2011 |

| April Box | | 56 | | Director | | n/a4 |

| Blake Bozman | | 49 | | Director | | n/a4 |

William D. Ellis2 | | 57 | | Director | | 2019 |

| William E. Fallon | | 66 | | Director | | n/a |

Ned N. Fleming, III1, 2 | | 59 | | Director | | 2017 |

Mark C. Griege1, 3, 5 | | 61 | | Director | | 2009 |

| Gordon Huddleston | | 37 | | Director | | n/a4 |

Steven D. Lerner2 | | 66 | | Director | | 2019 |

Manuel J. Mehos1, 3 | | 65 | | Director | | 2019 |

Gregory B. Morrison2 | | 60 | | Director | | 2017 |

John T. Sughrue3 | | 59 | | Director | | 2009 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Committees |

| Name of Nominee | | Age | | Director Since | | Compensation | | Audit | | Corporate Governance and Nominating | | Risk |

| C. Malcolm Holland, III | | 63 | | 2009 | | | | | | | | |

| Arcilia Acosta | | 56 | | 2021 | | | | ü | | ü | | |

| Pat S. Bolin | | 72 | | 2011 | | ü | | | | | | |

| April Box | | 59 | | 2017 | | | | | | ü | | ü |

| Blake Bozman | | 52 | | 2009 | | C | | | | | | |

| William D. Ellis | | 60 | | 2019 | | | | | | | | ü |

| William E. Fallon | | 69 | | 2020 | | ü | | | | | | C |

Mark C. Grieget | | 64 | | 2009 | | ü | | | | ü | | |

| Gordon Huddleston | | 40 | | 2017 | | | | ü | | | | |

| Steven D. Lerner | | 69 | | 2019 | | | | C | | | | |

Manuel J. Mehos | | 68 | | 2019 | | | | | | | | ü |

| Gregory B. Morrison | | 63 | | 2017 | | | | ü | | C | | |

| John T. Sughrue | | 62 | | 2009 | | | | | | ü | | ü |

1ü - Committee Member CompensationC - Committee

2 Member, Audit Committee

3 Member, Corporate Governance and Nominating Committee

4 Ms. Box and Messrs. Bozman and Huddleston previously served on our Board. Each resigned effective as of January 1, 2019 and has since served as an advisor to the Board.

5 Mr. Griege serves as Chair t Lead Independent Director

C. Malcolm Holland, III. C. Malcolm Holland, III founded Veritex and has been Chairman of the Board, Chief Executive Officer and President of Veritex since 2009, and Chairman of the Board of Directors, Chief Executive Officer and President of the Bank since its inception in 2010. Prior to founding Veritex, Mr. Holland served in various analyst, lending and executive management positions at various banking institutions located in the Dallas banking market from 1982 to 2009. Mr. Holland is a past president of the Texas Golf Association and served on the Executive Committee of the United States Golf Association from 2013 through 2018. Mr. Holland is an active member and chairman of the business advisory committee of Watermark Community Church and currently serves as a board member for Cannae Holdings, Inc., a publicly traded company engaged in acquiring and actively managing companies. He served as chairman of the College Golf Fellowship from 2002 to 2013. Mr. Holland received his Bachelor of Business Administration from Southern Methodist University in 1982. With over 35 years of banking

experience in the Dallas metropolitan area, Mr. Holland’s extensive business and banking experience, in-depth knowledge of the company and his community involvement and leadership skills qualify him to serve on our Board and as its Chairman.

Arcilia Acosta. Arcilia Acosta joined our Board in February 2021. Ms. Acosta is the President and Chief Executive Officer of CARCON Industries & Construction, a private company, specializing in commercial, institutional, and transportation construction, and is also the Chief Executive Officer and controlling principal of STL Engineers, a private company engaged in providing engineering and construction services. Ms. Acosta serves on the board of directors of the Communities Foundation of Texas, is Co-Chairman of the Texas Institute for Women in Leadership, and Chairman-Elect of the Dallas Citizens Council. She is also currently on the board of directors of Vistra Corp., a public company engaged in retail and electric power generation, and Magnolia Oil & Gas, a public company engaged in oil and gas exploration and development. Ms. Acosta previously served on the national advisory Board of BBVA Compass Bank, a global financial services company, and the Texas Tech National Alumni Association. Prior board service includes six years on the board of Legacy Texas Financial Group, Inc., a bank that is now part of Prosperity Bank, and ten years on the board of Energy Future Holdings Corporation, a public company formerly engaged in electric transmission, distribution, generation and retail operations. Ms. Acosta received a Bachelor of Arts from Texas Tech University, Board Director Certification from Southern Methodist University Southwest School of Banking and is a graduate of the Harvard University of Business School Corporate Governance Program. Ms. Acosta is well-qualified to serve as a director because of her leadership skills and extensive experience as a director of financial service and other companies.

Pat S. Bolin. Pat S. Bolin joined our Boardboard in March 2011 upon our acquisition of Fidelity Bank of Dallas. Mr. Bolin is the Executive Chairman of the board directorsBoard of Eagle Oil & Gas Co., a private independent oil and gas company based in Dallas founded by Mr. Bolin in 1976. Mr. Bolin began his professional career as a landman for Mitchell Energy Corp. in 1973. Mr. Bolin currently serveshas previously served on the boardboards of directors of Fidelity Bank, in Wichita Falls, Texas and its holding company, FB Bancshares, Inc., Mercantile Bank & Trust and Fidelity Bank of Dallas. Mr. Bolin also serves on the board of directors for Goodwill Industries and the executive board of the Southern Methodist University Cox School of Business and was recently appointed to the Southern Methodist University Alumni Board. Mr. Bolin received a Bachelor of Arts in Psychology from Southern Methodist University in 1973. Mr. Bolin’sBolin's diverse business and community banking experience along with his extensive community involvement qualify him to serve on our Board.board.

April Box.April Box has serve on our Board since 2020. She also served on our Board from 2017 to 2018, and as a Board advisor during 2019. Mrs. Box is the former President and Chief Executive Officer of Methodist Health System Foundation and Senior Vice president of external affairs for Methodist Health System. Mrs. Box holds a Bachelor of Arts degree from Rhodes College, Memphis, Tennessee, and a Master of Liberal Arts degree from Southern Methodist University in Dallas, Texas. Active in community and philanthropic service, she is a member of the World Presidents Organization, the International Women’s Forum, and currently serves as a board member for the State Fair of Texas. In 2013, Mrs. Box was recognized as the Outstanding Fundraising Executive at the National Philanthropy Day Awards Luncheon, presented by the Association of Fundraising Professionals Greater Dallas Chapter. Ms. Box’s significant experience and executive positions at Methodist Health System Foundation, her longstanding community involvement and her perspective and knowledge of the Dallas market qualify her to serve on our board.Board.

Blake Bozman. Blake Bozman Blake Bozmanhas served on our boardBoard since 2020. He also served on our Board from 2009 to 2018 and as a Board advisor during 2019. Mr. Bozman is a Managing Director of Freedom Truck Finance, a secondaryprivate company truck finance company providing truck finance secondary lending services based in Dallas. Mr. Bozman also oversees the operations of Prattco International, Inc., a family-owned business specializing in real estate investments and purchasing oil and gas properties. From 1995 to 2006, Mr. Bozman was with Drive Financial Services, a consumer finance company focused on sub-prime auto finance, which he co-founded in 1995 and served as Executive Vice President of Sales and Originations. Mr. Bozman received a Bachelor of Arts in Marketing from Southern Methodist University in 1993. Mr. Bozman’s business experience, particularly in the consumer financial services industry, qualifies him to serve on our Board.

William D. Ellis. William D. Ellis joined our Board in 2019, having served as Vice Chairman at Green Bancorp, Inc. (“Green”) since October 1, 2015 and as Vice Chairman at Green Bank N.A. (“Green Bank”) since October 1, 2015. Previously, he was the Founder and Chairman of Patriot Bancshares, Inc., headquartered in Houston, and served as its Chief Executive Officer and a director from its inception in 2005. Prior to his tenure with Patriot Bancshares, Inc., Mr. Ellis held senior executive positions with several other financial institutions, including Texas Regional President for Union Planters Bank in Houston and Senior Vice President Regional Retail Banking Manager for BB&T in Washington, D.C. He currently serves on The Board of Advocates of The Truett Seminary at Baylor University and is a former director of Theater Under the Stars and Mission Centers of Houston. Mr. Ellis

received his Bachelor of Science from Mississippi College and his Master of Business Administration from the University of North Alabama. Mr. Ellis's qualifications to serve on our Board include his leadership of Patriot Bancshares, Inc. since its inception, his extensive experience in the banking industry and his longstanding relationships within the business, political and charitable communities.

William E. Fallon.If elected at the Annual Meeting, this will be William E. Fallon's first year serving onFallon joined our Board.Board in 2020. Mr. Fallon previously served as an Executive Vice President at PNC Bank, N.A., holding various roles, including Chief Commercial Credit OfficeOfficer from 1996 to 2018 and Merger and Acquisition Leader from 2003 to 2018 and oversaw Wholesale Lending Originations from 1978 to 1996. In addition, Mr. Fallon served on the Executive Committee of The United States Golf Association from 2012 to 2017 and currently serves on the Executive Committee of West Penn Golf Association, and is a Director-Emeritus of the Pittsburgh Zoo & PPG Aquarium. Mr. Fallon received his Bachelor of Business Administration from the University of Notre Dame and his Master of Business Administration from The Ohio State University. Mr. Fallon's qualifications to serve on our Board include his extensive experience in the banking industry and his longstanding relationships with individuals and institutions in the industry.

Ned N. Fleming, III. Ned N. Fleming served on

Mark C. Griege. Mark Griege joined our Board fromin 2009, to 2013 and as a Board observer from 2013 to 2016 and rejoined the Board as a director in 2017. Mr. Fleming rejoined our Board and has served as a director since 2017. Mr. Fleming is a founder and Managing Partner of SunTx Capital Partners. Hecurrently serves as Chairmanthe Lead Independent Director of Construction Partners which is publicly traded on NASDAQ under ROAD, NationsBuilders Insurance ServicesVeritex Holdings Inc, after previously serving as chair of the Compensation and Big Outdoor, LLC. Mr. Fleming also serves as Vice-Chairman of Interface Security Systems. Prior to his time at SunTx Capital Partners, Mr. Fleming served as President and Chief Operating Officer of Spinnaker Industries, a publicly traded materials manufacturing company, until its sale in 1999. During his tenure, the company transformed from a small regional manufacturing business into a publicly traded acquisition platform with a national footprint. Previously, Mr. Fleming worked at a Dallas-based private investment firm where he led acquisitions in the

food and beverage and defense industries. Prior to that, Mr. Fleming was a consultant for The Boston Consulting Group, and worked for Fleming Companies. Mr. Fleming holds a Master of Business Administration with distinction from Harvard Business School and a Bachelor of Arts in Political Science from Stanford University. His significant financial expertise and leadership of SunTx Capital Partners and business experience with publicly traded companies qualify him to serve on our Board.

Audit Committees. Mark C. Griege. Mark C. Griege has served on our Board since 2009. Mr. Griege is the Chief Executive OfficerCEO and co-founder of RGT Wealth Advisors, a largean independent wealth management firm based in Dallas whichthat serves the needs of high net worth individuals and family offices with approximately $5.8 billion under management. Mark brings over 35 years of investment and business experience to the Veritex Board, spending the bulk of his professional career in the wealth management profession with prior experience in the tax departments of a "Big Four" accounting firm and a regional law firm. Mark enjoys an active life in both the professional realm and the local community. He has previously served on the boards of Schwab Institutional, the Institute of Financial Planners, and the editorial advisory board of the Journal of Financial Planning. He is also active in the community, serving on the boards of several philanthropic foundations associated with the charitable efforts of his clients. In addition, he's an active member of Watermark Community Church and on the board of Dallas National Golf Club. Mark has been recognized by Worth Magazine and D Magazine as one of its "Best Financial Advisors" and he co-founded in 1985. Mr. Griegefrequently speaks on a variety of investment and financial planning topics. Mark received ahis Bachelor of Business Administration from Southern Methodist University in 1981, and a Jurishis Doctor of Jurisprudence from the University of Texas School of Law in 1985. His significant experience and leadership at RGT Wealth Advisors brings a variety of investment and business perspectives and insights to our Board and qualifies him to serve on our Board.

Gordon Huddleston.Gordon Huddleston Gordon Huddlestonhas served on our boardBoard since 2020. He also served on our Board from 2017 to 2018 and as a Board advisor during 2019. Mr. Huddleston served on the Bank’s board of directors from 2012 to 2018. Mr. Huddleston is a Partner of Aethon Energy, a Texas-based private investment firm focused on direct investments in North American onshore upstream oil and gas assets, and has served as Co-President since 2013. From 2010 to September 2013, Mr. Huddleston served as Aethon’s Chief Investment Officer. Mr. Huddleston graduated from Vanderbilt University with a Bachelor of Science. in Engineering Science. His business experience and leadership at Aethon Energy qualifiesskill qualify him to serve on our Board.

Steven D. Lerner. Steven D. Lerner joined our Board in 2019. He was an independent director, Chairman of the Audit Committee and Chairman of the Nominating and Corporate Governance Committee at Green and served as a director of Green Bank from 2006 to 2019. Mr. Lerner is the Chief Executive Officer of TRC Ventures, L.P. (formerly The Redstone Companies, LP). Previously, he held the position of President of Redstone Companies Real Estate, LLC and was Executive Vice President and General Counsel of The Redstone Companies and numerous Redstone-related entities since 1998. Before that, Mr. Lerner was a partner of the Houston law firm now known as Schlanger Silver, Barg & Paine, LLP. He is a member of the State Bar of Texas. Mr. Lerner received a Juris Doctor with honors from the University of Texas School of Law, where he was a member of the Texas Law Review. Mr. Lerner is also the Vice-ChairmanChairman of the Board of Directors of Reinvestment Zone 16, City of Houston and the Uptown Development Authority as well as a Director of Harris County Improvement District #1 (the Uptown District in Houston). Mr. Lerner’sLerner's extensive financial and investment experience, including his significant financial and accounting expertise, his experience in the development of and investment in real estate, his longstanding relationships within the business, political and charitable communities, as well as his previous service with Green and Green Bank, qualifies him to serve on our Board.

Manuel J. Mehos. Manuel J. Mehos joined our Board in 2019. Mr. Mehos served as chairman of the board of directors of Green Bank and served as Chairman and Chief Executive Officer of Green sincefrom its inception in 2004.2004 through 2019. Green was acquired by the Company on January 1, 2019. Prior to founding Green Bancorp in 2004, Mr. Mehos was the founder, Chairman of the board of directors and Chief Executive Officer of Coastal Bancorp, Inc. and its banking subsidiary, Coastal Banc, a publicly-traded company that was later acquired by Hibernia Corporation. Mr. Mehos is a Certified Public Accountant. He currently serves as a director on the board for Sentinel Trust Company. He has served as a director on the board for Federal Home Loan Bank of Dallas, one year as Chairman of the board. He has also served as a director on the boards of Texas Finance Commission, Texas Savings & Community Bankers Association and America's Community Bankers. Mr. Mehos received his Bachelor of Business Administration and Master of Business Administration from the University of Texas. Mr. Mehos' qualifications to serve on our Board include his extensive experience in the banking industry, his in-depth knowledge of Green (which is now part of the Company) and his previous experience serving as chairman of the board of directors of publicly-traded companies.

Gregory B. Morrison. Gregory B. Morrison has served on our Board since 2017 and2019. Mr. Morrison has served on the Bank’s board of directors since December 2016.2018. Mr. Morrison is the former Senior Vice President and Corporate Chief Information Officer offor Cox Enterprises, Inc., a holding company for communications and is responsible for all facets of the corporation’s information systems and transaction processing requirements. From 1989automotive services companies, a role he held from February 2002 until his retirement in January 2020. Prior to 2002,his role at Cox, Mr. Morrison served as Executive Vice President and Chief Operating Officer of InformationRealEstate.com, an online real estate company that is now part of Zillow, in 2000 and held various information and technology leadership roles at Prudential Financial, Inc. From January, a global financial services company, from 1989 to November 2000,2002. Mr. Morrison served as Chief Operating Officer for RealEstate.com.has extensive knowledge and expertise with large-scale business transformations and technology deployments. Mr. Morrison earned hiswas named among the industry's top performing CIOs who have shown unparalleled leadership to drive innovation and transformation in businesses. Mr. Morrison also serves on the board of directors of Rollins, Inc. and Veritiv Corp, roles he has held since 2021. Mr. Morrison was a commissioned officer in the US Army from 1982 to 1989. Mr. Morrison received a Bachelor of Science in Mathematics and Physics from South Carolina State University, in math and physics, and a Master of Science in industrial engineeringIndustrial Engineering from Northwestern University. Mr. Morrison’s significant leadership and technical experience as Chief Information Officer of Cox Enterprises, Inc. qualifies him to serve on our Board.

John T. Sughrue. John T. Sughrue has served on our Boardas a director of the Company since 2009. Mr. Sughrue currently serves as the Chairman of FIG Enterprises, Inc., the parent company of the Fashion Industry Gallery, a boutique wholesale venue for the fashion retail trade. Mr. Sughrue also serves as a directorDirector and the Chief Executive Officer of Brook Partners, Inc., a diversified real estate company based in Dallas, which he founded in 1994. From 2007 to 2009, Mr. Sughrue served as an advisory board member for the Texas Region of Colonial Bank. From 1987 to 1989, Mr. Sughrue was an associate at Merrill Lynch Capital Markets and from 1983 to 1985 he was a Real Estate Lending Officer at Chemical Bank. Mr. Sughrue received a Bachelor of Arts in Economics from Harvard College in 1982 and a MasterMasters of Business Administration from the

Amos Tuck School of Business at Dartmouth College in 1988. Mr. Sughrue’sSughrue's significant business experience and community involvement qualifies him to serve on our Board.board.

Shareholder Approval

The affirmative vote of a plurality of the votes cast at the Annual Meeting is required for the election of each of the nominees for director.

THE BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL OF THE NOMINEES LISTED ABOVE TO THE BOARD.

COMPENSATION OF DIRECTORS

During 2019,2022, each of our non-employee directors received a cash retainer of $25,000 for his or her service as a director of the Company. In addition, the chair of the Audit Committee, the chair of the Compensation Committee, and the chair of the Corporate Governance and Nominating Committee and the chair of the Risk Committee, each received an additional cash retainer of $15,000, $12,500, $10,000$12,500, and $10,000,$12,500, respectively, for their service in those roles. Each director serving on any committee of the Board received an additional cash retainer of $2,500$3,750 for his or her service on a committee. Any director who was also an employee did not receive any fees or other compensation for their service as a director of the Company.

The following table sets forth compensation paid, earned or awarded during 20192022 to each of our non-employee directors. Each of our current non-employee directors is also a director serving on the board of directors of the Bank. In accordance with our director compensation policy, the aggregate amounts reflected below were paid to directors for their service on the Board and the board of directors of the Bank. All of the cash amounts shown in the table below were paid by the Bank.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | Stock Awards ($)1 | | Total ($) |

| C. Malcolm Holland, III | | $ | — | | | | $ | — | | | | $ | — | |

| Pat S. Bolin | | — | | | | 122,890 | | | | 122,890 | |

| William D. Ellis | | 56,250 | | | | 64,140 | | | | 120,390 | |

| Ned N. Fleming, III | | — | | | | 127,890 | | | | 127,890 | |

| Mark C. Griege | | — | | | | 146,640 | | | | 146,640 | |

| Steven D. Lerner | | — | | | | 129,140 | | | | 129,140 | |

| Manuel J. Mehos | | — | | | | 126,640 | | | | 126,640 | |

| Gregory B. Morrison | | — | | | | 120,390 | | | | 120,390 | |

| John T. Sughrue | | — | | | | 129,140 | | | | 129,140 | |

1 The amounts All of the stock awards shown in this column include 3,000the table below are time-based restricted stock units ("RSUs") awardedissued by the Company. With respect to directors on March 31, 2019. cash awards, each director has the option to receive additional RSUs in lieu of cash.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | Stock Awards ($)1 | | Total ($) |

| Arcilia Acosta | | 60,000 | | | 75,000 | | | 135,000 | |

Pat S. Bolin2 | | — | | | 133,750 | | | 133,750 | |

| April Box | | 60,000 | | | 75,000 | | | 135,000 | |

Blake Bozman2 | | — | | | 142,500 | | | 142,500 | |

William D. Ellis2 | | — | | | 131,250 | | | 131,250 | |

| William E. Fallon | | 71,250 | | | 75,000 | | | 146,250 | |

Mark C. Griege2 | | — | | | 192,500 | | | 192,500 | |

| C. Malcolm Holland, III | | — | | | — | | | — | |

Gordon Huddleston2 | | — | | | 133,750 | | | 133,750 | |

| Steven D. Lerner | | 67,500 | | | 75,000 | | | 142,500 | |

| Manuel J. Mehos | | 62,500 | | | 75,000 | | | 137,500 | |

Gregory B. Morrison2 | | — | | | 143,750 | | | 143,750 | |

John T. Sughrue2 | | — | | | 137,500 | | | 137,500 | |

1 The RSUs are disclosed as the aggregate grant date fair value of the awards, determined in accordance with ASC Topic 718. The assumptions used in calculating the grant date fair value of these awards are included in note 22Note 21 of the notesNotes to our consolidated financial statementsConsolidated Financial Statements contained in our Annual Report on Form 10-K for the year ended December 31, 2019.2022.

2 Director elected to receive stock in lieu of cash payments during 2022.

All non-employee directors have been and will continue to beare reimbursed for their reasonable out-of-pocket travel, food, lodging and other expenses incurred in attending meetings of our Board or any committees thereof.thereof consistent with Company practice. Directors are also entitled to the protection provided by the indemnification provisions in our certificate of formation and bylaws, as well as the articles of association and bylaws of the Bank.

BOARD AND COMMITTEE MATTERS

Board Meetings

Our BoardBoard met 12 timestimes during the 20192022 fiscal year (including regularly scheduled and special meetings). During the 20192022 fiscal year, each director participated in 75% or more of the total number of meetings of the Board (held during the period for which he or she was a director) and each director participated in 75% or more of the total number of meetings of all committees of the Board on which he or she served (held during the period that he or she served). In addition to Board and committee meetings, our directors also engaged in less formal communications between meetings, including discussions, briefings and communications regarding key issues, with our Chairman, lead independent director, committee chairs and members of senior management.

Our 20192022 annual meeting of shareholders, held on May 21, 2019, included the attendance of three directors.17, 2022, seven directors were in attendance. It is our recommendation that each director standing for election at the Annual Meeting attend the Annual Meeting in person or via live webcast.Meeting. We anticipate all of our nominees for election will attend the Annual Meeting in person or via live webcast.Meeting.

Director Independence

Under the applicable ruleslisting standards of the Nasdaq Stock Market, LLC (“Nasdaq”), a majority of the members of our Board are required to be independent. A director is independent for purposes of the Nasdaq listing standards if such director does not have a relationship which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, The rules of Nasdaq listing standards, as well as thosethe rules of the SEC, also impose several other requirements with respect to the independence of our directors.

OurThe Corporate Governance and Nominating Committee and our Board has evaluated the independence of each director and nominee based on these standards and rules. Applying these standards and rules, the Corporate Governance and Nominating Committee and our Board has determined that, with the exception of Mr. Holland, each of our current directors and nominees qualifies as an independent director under applicable legal standards and rules. In making these determinations, ourTo assess independence, the Corporate Governance and Nominating Committee was provided with information about relationships between the independent directors (and their immediate family members and affiliated entities) and Company and its affiliates. Among other things, the Board consideredreviewed the following:

•The commercial transactions between the Company and the Bank on the one hand and directors (and their immediate family members and affiliated entities) on the other hand, including loans made by the Bank in the ordinary course of business; and

•The current and prior relationships that each director and nominee has with us and all other facts and circumstances, including that two of our Boarddirectors, William D. Ellis and Manual J. Mehos, are former executives of Green, which was acquired by the Company on January 1, 2019.

The Corporate Governance and Nominating Committee also considered all other facts and circumstances they deemed relevant in determining their independence, including the beneficial ownership of our common stock by each director and nominee, and theany other transactions described under the heading “Certain Relationships and Related Person Transactions” in this proxy statement.

Board Leadership Structure

C. Malcolm Holland, III currently serves as Chairman of the Board and our Chief Executive Officer and President. Mr. Holland’s primary duties are to lead our Board in establishing our overall vision and strategic plan and to lead our management in carrying out that plan.

OurThe Board has the authority to combine or separate the positions of Chairman and Chief Executive Officer, but does not have a policy regardingrequiring the separation of the roles of Chief Executive Officer and Chairman of the Board, as ourBoard.Our Board believes that it is in the best interests of our company to make that determination from time to time based on the position and direction of our company, the identity of the Chief Executive Officer and the membership of our Board. Board, including the ability to identify and appoint a strong and capable lead independent director.Our Board has determined that having our Chief Executive Officer serve as Chairman of the Board is in the best interests of our shareholders at this time. This structure, coupled with oversight from our strong lead independent director, experienced chairs of our Board committees, and our other well-qualified directors, all of whom are independent, makes the best use of the Chief Executive Officer’s extensive knowledge of our company and the banking industry. Our Board views this arrangement as also providing an efficient nexus between our company as a whole and ourthe Board the ability to leverage Mr. Holland's knowledge of the day-to-day business of the Company, enabling our Board to obtain information pertaining to operational matters expeditiously and enabling our Chairman to bring areas of concern before our Board in a timely manner.The combined role, coupled with the strong lead independent director, has enabled the Board to be responsive to challenges and opportunities as they continue to arise.

Mr. Griege currently serves as our lead independent director. Mr. Griege serves as a liaison between the Chairman and the independent directors, presides over executive sessions of the independent directors, and consults with the Chairman on major corporate decisions, strategy and board meeting agendas. The independent lead director chairs regularly scheduled executive sessions which are held without the Chairman being present.The independent directors remain confident in Mr. Griege’s abilities to discharge the duties of lead independent director.

The lead independent director is nominated by the Corporate Governance and Nominating Committee and annually elected by all independent directors of the Board. When nominating and electing the lead independent director, our independent directors consider, among other things, candidates’ independence in accordance with Nasdaq listing standards and other applicable laws and regulations, knowledge of the Board, the Company, and banking industry, familiarity with corporate governance best practices and procedures, ability to achieve consensus and alignment among independent directors and between independent directors and the Chairman and ability to work effectively and constructively with and advise the Chairman.

Board Composition and Reassignments

The Company believes that an effective Board is composed of directors who bring diverse viewpoints and perspectives, exhibit a variety of skills, professional experience and backgrounds, and effectively represent the long-term interests of our shareholders. The Corporate Governance and Nominating Committee and the Board regularly consider these factors in the broader context of the Board’s overall composition, with a view toward selecting nominees who have the best skill set and experience to oversee the Company’s business and the broad set of challenges that it faces.

The Corporate Governance and Nominating Committee and the Board also understand the importance of Board and committee reassignments, and strive to maintain an appropriate balance of continuity and turnover on the Board and committees. The Board believes that new perspectives and new ideas are critical to a forward-looking and strategic board, as is the ability to benefit from the valuable experience and familiarity that longer-serving directors bring.

In the past three years, among other initiatives, our Board has:

•Expanded qualifications and diversity representation on the Board;

•Reassigned 3 committee chairs and 5 committee members; and

•Established a Risk Committee.

Shareholder Engagement and Outreach

We routinely engage with various stakeholders of the Company, including shareholders, rating agencies, proxy advisory services, and customers on a variety of matters. Our Board doesand management team greatly value the perspectives and feedback of our shareholders and engage with them on a broad range of topics, including our business strategy, financial performance, executive compensation, corporate governance, regulatory issues, diversity and inclusion and environmental and social goals. Our Board receives summaries and information regarding issues raised by shareholders and shareholder voting results. In addition, management routinely engages with investors, whether at conferences and other forums. We also speak with proxy advisors to discuss, and receive feedback on, our governance practices and other matters.

In 2022, we contacted many of our shareholders for the purpose of having a dialogue with them about a variety of topics. A number of shareholders accepted our offer to engage, and we plan to continue this outreach on a regular basis. Members of our Board, including a member of our Corporate Governance and Nominating Committee participated in discussions with certain shareholders. Not all shareholders whom we contacted accepted our invitations to engage, in certain cases noting that they did not have any concerns to raise at that point in time.

| | | | | |

We held in-person and telephonic meetings with 17 of our Top 25 Shareholders | Representing over 27% of our outstanding common stock |

Feedback from these in-person and telephonic meetings was generally positive with many shareholders expressing appreciation for our corporate strategy, Board composition (diversity and qualifications), Board oversight of risk, our executive compensation program and philosophy, corporate responsibility, ESG strategy, succession plans, and human capital management. Discussions regarding the implementation of a succession plan were, and continue to be, held with investors with regards to retirement plans and what the Company is doing to prepare for such retirement plans.

Shareholders who wish to speak to any of our directors, including the lead independent director or the chair of any of our Board committees, or a Company representative may communicate as follows:

| | | | | |

| Mail: | Telephone: |

| |

Veritex Holdings, Inc.

8214 Westchester Drive, Suite 800

Dallas, TX 75225

Attn: Investor Relations | 1.972.349.6200 |

Shareholders can also view information and request documents from the Investor Relations page of our website at https://ir.veritexbank.com/. Shareholder communications are distributed to the Board, or to any individual director or directors, as appropriate, depending on the facts and circumstances outlined in the communication.

The engagement with shareholders described above was conducted by members of our management, including C. Malcolm Holland, III, our Chief Executive Officer, and Terry Earley, our Chief Financial Officer.Certain independent directors, including Gregory B. Morrison and John T. Sughrue, also participated in discussions with certain shareholders.The results of our shareholder engagement initiative were reported to both the Corporate Governance and Nominating Committee and the Board, which considered what actions would be appropriate to address the issues and concerns raised.

Board Diversity

While the Board has not adopted a formal written policy regarding director diversity, in selecting nominees to serve as directors, the Corporate Governance and Nominating Committee takes into account the diversity of a director candidate’s perspectives, background and other demographics, including race, gender, ethnicity and nationality. We believe it is important that our Board is composed of individuals reflecting the diversity represented by our employees, our customers, and our communities. The following table sets forth certain Board diversity information with respect to each director, utilizing the template in accordance with NASDAQ's board diversity listing standards. The information is based on voluntary self-identification by each Board member.

| | | | | | | | | | | | | | |

| Board Diversity Matrix (As of April 5, 2023) |

| Total Number of Directors | 13 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 2 | 11 | 0 | 0 |

| Part II: Demographic Background | | | | |

| African American or Black | 0 | 1 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 1 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 1 | 10 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

Director Resignation Policy

In accordance with our Director Resignation Policy, by accepting a nomination for election or re-election as a director, each director agrees that if, in an uncontested director election, he or she receives a greater number of “withhold” votes than votes “for” election, such director will tender his or her resignation in writing to the Board promptly, but no later than ten days after the certification of the shareholder vote.

In the event of a resignation pursuant to our Director Resignation Policy, the Corporate Governance and Nominating Committee will meet to consider all relevant factors, including (a) the reasons expressed by shareholders who cast "withhold" votes in relation to the resigning director, (b) the expected effects on the Company that would result from accepting the resignation and (c) any other factors bearing on the best interest of the Company and its shareholders, and make a recommendation to the Board. The Board will act on the recommendation within 90 days following certification of the election results. In doing so, the Board will take into account the factors considered by the Corporate Governance and Nominating Committee and any additional relevant information. A resigning director must recuse himself or herself from participating the deliberations of the Corporate Governance and Nominating Committee and the Board in relation to his or her resignation.

The Company, within four business days after the Board takes formal action with respect to the recommendation made by the Corporate Governance and Nominating Committee, will publicly disclose, in a Form 8-K file with the SEC, the decision of the Board as to whether to accept or reject the resignation, together with a brief statement of the reasons for taking such action.

Board and Corporate Governance

The Board is committed to providing sound governance for the Company. The Board has adopted Corporate Governance Guidelines (the “Guidelines”) for the Company and charters for each committee of the Board to provide a flexible framework of policies relating to the governance of the Company. These Guidelines and charters delineate the responsibilities of our directors, Board, and Board committees, as well as standards for Board composition, service, and meetings, and are reviewed annually to ensure standards remain consistent with evolving business needs and best practices. These documents are available in the “Corporate Governance” section of the Company’s website at https://ir.veritexbank.com.

Governance practices include, but are not limited to:

•Our Board conducts an annual performance evaluation to assess whether the Board members and Board committees are functioning effectively;

•Our Board has a lead independent director.director and lead independent chair of each Board committee;

•All directors are independent, other than our CEO

•All of the members of our principal standing committees (consisting of our Audit, Compensation and Corporate Governance and Nominating Committees) are independent;

•Executive sessions of independent directors are held at each regular Board meeting;

•We have an active ongoing director education;

•We have a strong investor outreach program, including participation by our Chairman and other directors

•We have adopted stock ownership guidelines for directors and executives;

•We consider Board composition and reassignments on an ongoing basis; and

•Our Board has oversight responsibility for corporate responsibility and ESG matters.

The Board believes that establishing and maintaining an effective Board evaluation process is essential to implementing the Company’s governance program. Accordingly, the Corporate Governance and Nominating Committee reviews and approves the evaluation process annually to ensure that it continues to be an effective tool for identifying areas to enhance the performance of the Board and Board committees. In 2022, the evaluation process involved the following steps. First, each Board member assessed the performance of the Board as a whole and individual directors. Second, the results of the assessments were reviewed by the Corporate Governance and Nominating Committee. Third, the results were reported to the full Board. Fourth, the Corporate Governance and

Nominating Committee and the Board considered whether any revisions were needed in light of information reported.

Risk Management and Oversight

Our Board is responsible for oversight of management and the business and affairs of our company,the Company, including those relating to management of risk. Our Board determines the appropriate risks for us generally, assesses the specific risks faced by us, and reviews the steps taken by management to manage those risks. While our full Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. In particular, the Audit Committee assists our Board in assessing and managing our exposure to risk, including major financial risk exposures. The Compensation Committee is responsible for reviewing the relationship between our risk management policies and practices, corporate strategy and compensation arrangements, and evaluating whether incentive and other forms of pay encourage unnecessary or excessive risk-taking. Our Corporate Governance and Nominating Committee monitors the risks associated with our governance program. The Risk Committee is responsible for overseeing the independenceCompany's overall risk framework, risk appetite and management's identification, measurement, monitoring and control/mitigation of our Board.key risks facing the Company. Management regularly reports on applicable risks to the relevant committee or the full Board, as appropriate, with additional review or reporting on risks conducted as needed or as requested by our Board and its committees.

In addition, each standing committee of our

IT Risks

The Board also has oversight responsibility for risks inherent within its area of oversight. For example, the Boardan IT Steering Committee, which oversees the information technology security, including

cybersecurity issues, considerations and developments. Among other responsibilities, the Board IT Steering Committee reviews and discusses with management, as and when appropriate, risk management and risk assessment guidelines and policies regarding information technology security, including the quality and effectiveness of information technology security and disaster recovery capabilities.

Compensation Policies and Practices and Risk Management

We do not believe any risks arise from our compensation policies and practices for our executive officers and other employees that are reasonably likely to have a material adverse effect on our business, results of operations or financial condition.

Board Committees

Our Board has established standing committees in connection with the discharge of its responsibilities. These committees include an Audit Committee, a Compensation Committee, and a Corporate Governance and Nominating Committee and a Risk Committee. The Board also has an IT Steering Committee, which is discussed above.

In the future, our Board may establish such additional committees as it deems appropriate, in accordance with applicable law and regulations and our certificate of formation and bylaws.

Audit Committee